Full Timeline of MY Homebuyers' Experience

1. Mortgage Pre Approval

The first question that any realtor in the city is going to ask you if you’re going to put an offer into a house is if you’re pre approved for a mortgage. So it’s important to do this prior to starting your search as it gives you your budget and how much you can spend.

I don’t show any properties to clients until they have a pre- approval letter. This is because if we see a house that is 400k and you fall in love with it and THEN you get approved for 370k and you fall short. Any house afterwards will not compare to the house that you couldn’t afford.

2. Understand Your Closing Costs

This is key to know before going on showings and you should allocate 2.5%- 3% of the purchase price towards the following:

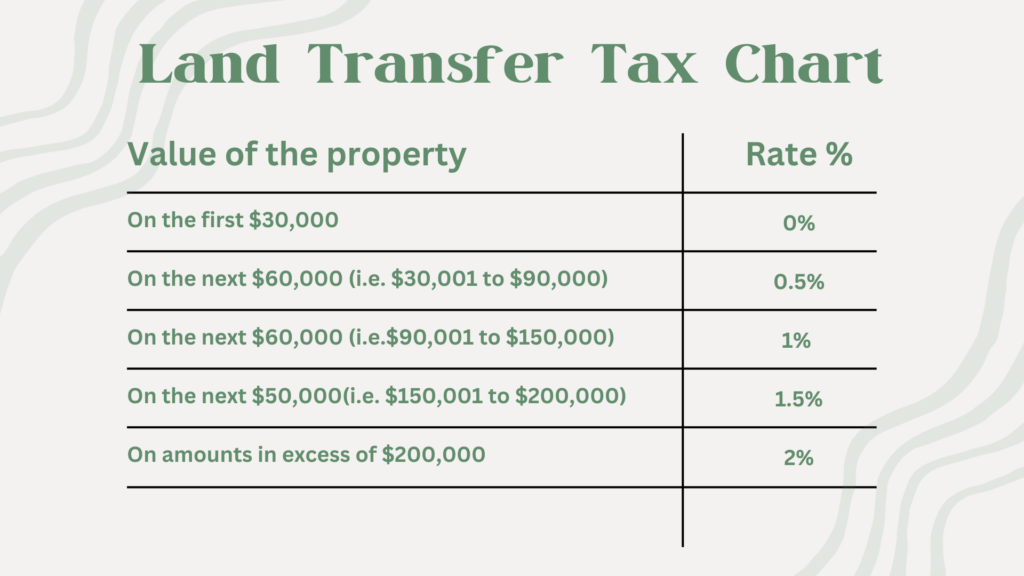

- Land Transfer Tax

- Real Estate Lawyer

- Home Inspection

You don’t pay for me, the sellers pay me. So you don’t have to worry about that expense coming out of your pocket.

3. Viewing Homes

Now that you understand what the financial commitment looks like of purchasing a home, you can start looking at homes.

I can’t preach enough how important it is to get a trusted real estate agent at this point of your search.

This is where REALTORS show their true value and expertise about homes and the value of the characteristics within a home.

4. Submitting an Offer

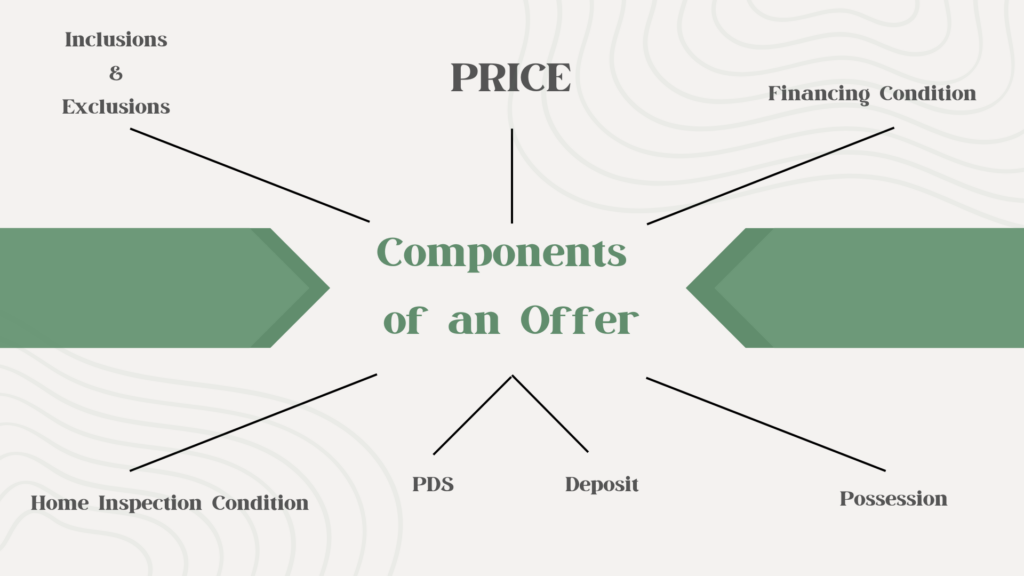

Submitting an offer is the most nerve-racking part of the entire process. This is when you’ll know if you’ve gotten a house

Over the last couple years home buying has been competitive and we still see multiple offers today.

We all have different ways of being competitive but what’s most important to me aside from the price is preparedness during offers night.

- Pre Approval Letter

- Pre Inspection

- Submitting an offer on time

- Deposit

There are so many strategies but the most important piece is that you and me are in constant communication of what strategy we’re going to imply before we submit an offer.

5. After an Accepted Offer

Congratulations! You’re offer is accepted! Unfortunately the job is not finished and this is where we see some common mistakes.

Keep up with your credit score and don’t incur any new debts.

Lenders can check you’re eligibility for a mortgage approval up until possession. So don’t change your financial situation at all.

Alongside this there are a few additional things that will happen after you have an accepted offer:

- Deposit drop off 24 hours after accepted offer.

- Contact with lawyers will begin.

- Start contacting Home Insurance Agencies and get that done prior to posseession

- Inquire about Title insurance to your lawyer.

6. Possession Day

Getting Ready to Move into your new home can be super stressful.

There is just 1 thing I would recommend as you settle in.

Within 24 hours of the start of your possession check every appliance, light switch, and included items in the house.

Most realtors add the clause “mechanical, electrical, plumbing and included items to be in working order at the day of possession.”

So if there’s anything wrong, then you have that 1 day to check EVERYTHING.

Start Today!

There are only a few steps that go into purchasing a home but if not done correctly you could see some hiccups along the way.

If you want to start today and think you’re ready to make the tough choice to purchase a home; let’s meet and figure out where you are along this timeline and how we can get you to the possession day!